Executive Summary:

International equity markets rose during the first quarter of the year, prompted by rotations out of the United States as aggressive tariff and diplomatic rhetoric from the new administration raised uncertainty.

Capital flowed from the United States, raising many international currencies relative to the U.S. Dollar during the first quarter.

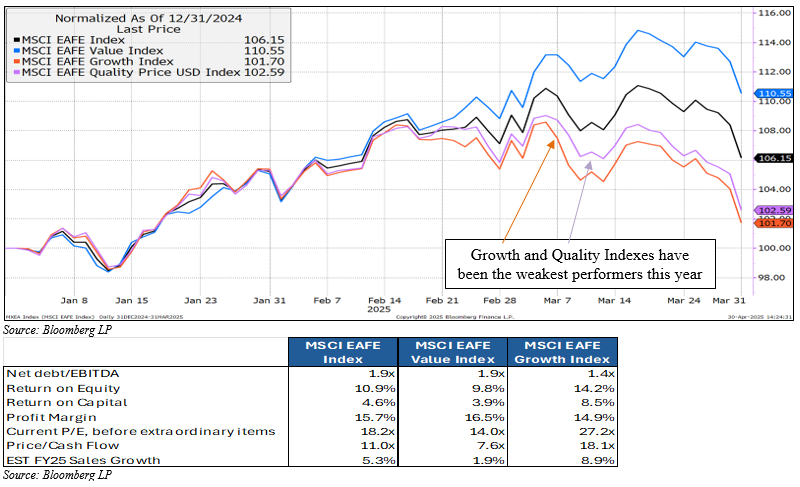

Overall, MSCI EAFE Index, which is USD denominated, returned 7.0% with more value-oriented segments of the equity market receiving the greatest benefit in international equity markets.

Extreme valuation discounts narrowed as many international equity markets rose.

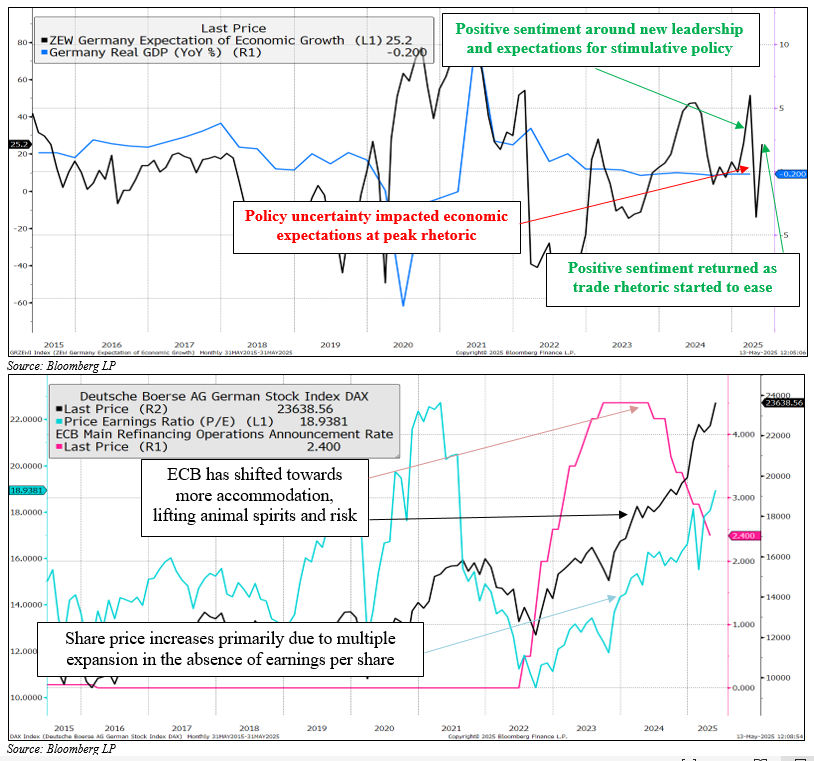

Probabilities for a recession increased for the U.S., as did inflation expectations, prompting stagflationary risks. This shift increased attractiveness of some international markets, such as Germany, where greater scope for fiscal and monetary policy held optimism for prospective economic recovery.

As the quarter drew to a close, sentiment slid to recent lows. Negotiations and trade frameworks have replaced initial disruptive rhetoric and anchoring over the past two months.

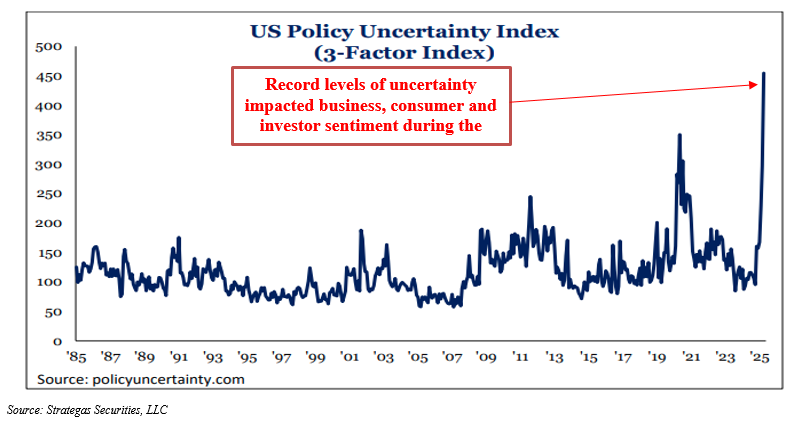

As such, a very fluid environment prevents confidence in global economic forecasts with elevated uncertainty.

Economic and Capital Markets Commentary

The international markets, as represented by the MSCI EAFE Index, rose by 7.0% during the first quarter. International markets were the beneficiaries of an aggressive rotation from United States’ assets into foreign securities. Though Europe started the year with some markets experiencing recession, the monetary policy by the European Central Bank, coupled with expansionary, fiscal proposals by new German leadership, have generated greater magnetism for capital. Conversely, the United States entered the year with a more optimistic outlook, but uncertainty spiked after the tariff bazooka cast a pall over solid, hard economic data, which was more representative of current conditions versus prospective conditions. The expansionary monetary and fiscal policies, coupled with a greater threat of U.S. economic weakness resulting from trade disruption, prompted capital migration.

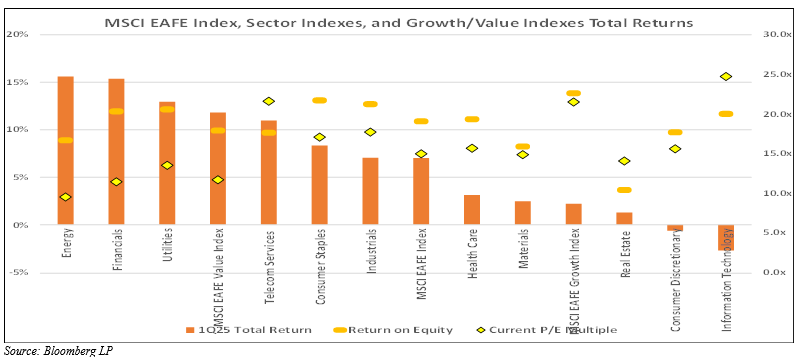

The capital invested, reflecting optimism for incrementally better economic prospects, raised the tide for the entire complex of public securities, but the greatest gains were recognized by the value index. Consistently, the MSCI EAFE Quality Price Index lagged other indexes meaningfully. This index is designed to measure the performance of “quality growth stocks” within the broader MSCI EAFE Index, focusing on high return on equity, stability of earnings’ growth, and low financial leverage. The divergence in styles commenced in February, after President Trump’s inauguration and initial tariff posturing. The MSCI EAFE Value Index typically consists of more economically sensitive companies with greater financial leverage, and these typically trade at discounts to their MSCI EAFE Growth Index counterparts.

Price action during the quarter reflects the cautious tone struck by capital markets as economic stress persisted and activity stalled in Europe. During the last quarter of the year, analysts revised their forecasts for earnings growth. After these revisions, headline earnings growth in 2025 is only expected to be ~5% for the aggregate in this index. Expectations now hinge heavily upon building momentum throughout this year and recognizing greater earnings contributions from a healthier economy forecast for the latter half of 2025 and into 2026. Many of these sectors have already been showing improvement in operating metrics, and some, like Utilities, remain less cyclically exposed. As the markets have moved into the second quarter, Utilities and Telecom remain part of leadership, while Energy dropped significantly, as its cyclical nature of demand reflected less sanguine forecasts.

The persistence of performance from these less-cyclically exposed sectors – namely, Utilities and Communication Services – does reflect greater anxiety around the global economy after Trump 2.0’s initial tariff announcements and more bellicose tone. Under the initial framework, the tariff regime would exact a tremendous tax on both the U.S. and global economies. The maximum proposed tariff rates would tax the U.S. economy more than $600bn, though these “worst case scenarios” are now being trimmed with the on-going negotiations and initial agreements. While it really remains premature for any concrete assumptions, the current administration attempts to navigate between supply-chain impact on inflation and induced recession, resulting from disrupted global trade, management paralysis, and economic tax. Realistically, any economic forecast at the current time is – somewhat – an exercise in futility.

Despite the durability of hard, economic data, uncertainty has plunged many measures of soft data into recessionary territory. While Europe has been struggling to gain any economic momentum, the United States experienced continued economic expansion through government spending and domestic consumption – principally, by high earners who now suffer from a negative wealth effect. During the first quarter, the Eurozone GDP grew 0.4%, which provided additional incentive for capital to flow into international markets. The combination of incrementally positive news, lower relative values, greater flexibility for stimulus, and less policy uncertainty – perhaps, coupled with a bit of patriotism – prompted a rotation.

International currencies experienced spikes in volatility to the upside that disrupted some of the foreign currency carry trade, which contributed to the U.S. premium valuations (borrow EU/buy USD, with low currency vol and yield arbitrage). A similar rotation in the Japanese yen occurred in 2024 due to interest rate differentials and contributed to a violent rotation in domestic equity markets last July. While many pundits speculate on the end of “American Exceptionalism,” the maximum pressure campaign by President Trump will likely soften as parties convene to explore constructive resolutions.

Trump v2.0 launched out of the gates with momentum that we have not witnessed in recent inaugurations. The “Liberation Day” on April 2nd was the culmination of a barrage of disruptive comments (51st state – Canada/Greenland, Ukraine War, Tariff warnings, etc). While these comments have created huge amounts of uncertainty, we do not expect failed negotiations to lead to an impasse that ensures mutual destruction. Recent progress with both United Kingdom and China has already brought sentiment relief from dire scenarios. Despite the incrementally softer tone since early April, any final outcome of trade negotiations remains many months away.

Though Germany’s economy continues to strive towards a recovery, the tariff uncertainty weighed on sentiment, despite stimulative domestic and European Union policy. The ZEW Germany Expectation of Economic Growth improved during the first quarter but plummeted after “Liberation Day.” This decline did not disqualify favorable capital flows into international markets, as relative valuation, economic outlook, rate outlook, and currency values all prompted re-allocations from the United States, as stagflationary risks rose for our domestic economy. A more constructive trade dialogue has emerged, and expectations have, hopefully, experienced their nadir. In Germany, the economic malaise over the last two years prompted new political leadership with a greater eye towards fiscal stimulus, while the European Central Bank continues forward with more accommodation, reducing three times already this year. These positive developments encouraged rotation into risk capital and equity pricing. As clouds of uncertainty lift over the tariff framework, we expect improvement in global economic sentiment.

China also experiences a period of both economic stress and trade disruptions. Though declining over the last seven years, the United States remains their largest trade partner, claiming ~15% of the total exports, which is roughly equivalent to aggregate exports to the European Union. Protectionist policies in one export market risks collateral damage in other trade relationships, as existing capacity searches for the best destination. Supply chain diversification continues to expand to reduce concentration in China, as exemplified by Apple’s decision to expand iPhone manufacturing in India. Such incremental shifts put pressure on a Chinese market plagued by elevated levels of debt and unclear economic health. China’s stated growth lacks credibility, and over the last few years, they have discontinued unflattering data series on land sales, unemployment insurance, youth unemployment, and – even – cremation rates, to name a few. According to the Wall Street Journal, Gao Shanwen, an economist for a state-owned institution, was banned in December from public speaking after stating that a more accurate estimate for growth “might be around 2%” over the past few years. China continues to push additional stimulus into the system with lower reserve requirement ratios, interest rate reductions, special lending facilities, and local government debt expansion. Their outlook continues to be uncertain with weak consumer, opaque markets, and exogenous pressure.

Mason D. King, CFA

May 16, 2025