Executive Summary:

* International markets (MSCI EAFE Index) rose 4.9% in Q4; value stocks outperformed growth, continuing a multi-year trend toward value.

* High-quality stocks underperformed the broader index, but the gap narrowed, suggesting the value rotation may be normalizing.

* The valuation gap between U.S. and international equities persists but narrowed slightly during the year.

* For 2025, over 80% of total return was driven by currency appreciation and multiple expansion.

* Financials performed strongly in Q4, benefiting from lower rates and steeper yield curves; Health Care and Utilities also outperformed, while Communication Services was the only sector with negative returns.

* Entering 2026, global economic conditions are mixed: Europe sees easing financing but faces fiscal constraints; France struggles with limited fiscal space and low consumer confidence.

* Euro Area growth is modest, supported by resilient consumers and gradual disinflation.

* China’s growth relies on exports as domestic investment and consumption weaken, raising trade tension risks.

* Japan faces sluggish growth and demographic decline, with inflation above target and accommodative monetary policy.

* Canada’s outlook is subdued, with stagnating productivity and a likely pause in monetary policy, signaling gradual disinflation.

* Across all regions, external shocks, policy uncertainty, and structural shifts in trade and investment will shape the economic landscape in 2026.

Economic and Capital Markets Commentary

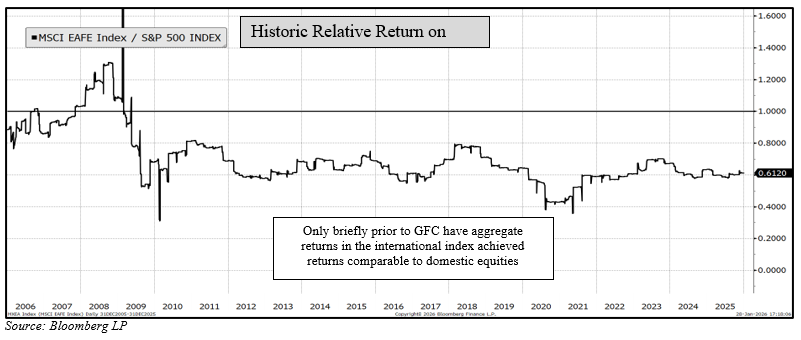

International developed markets delivered robust returns in 2025, with the MSCI EAFE Index rising approximately 31.9% for the year and outperforming the S&P 500 for the first time since 2022. The rally was broad-based, supported by strong gains in Europe and the United Kingdom, where the Stoxx Europe 600 achieved 35.2% and the FTSE 100 posted its best annual performance since 2009, gaining 34.2% in total returns in US Dollar terms. Currency strength in these markets contributed to overall performance, as the USD Index fell 10.7% during the first six months of the year.

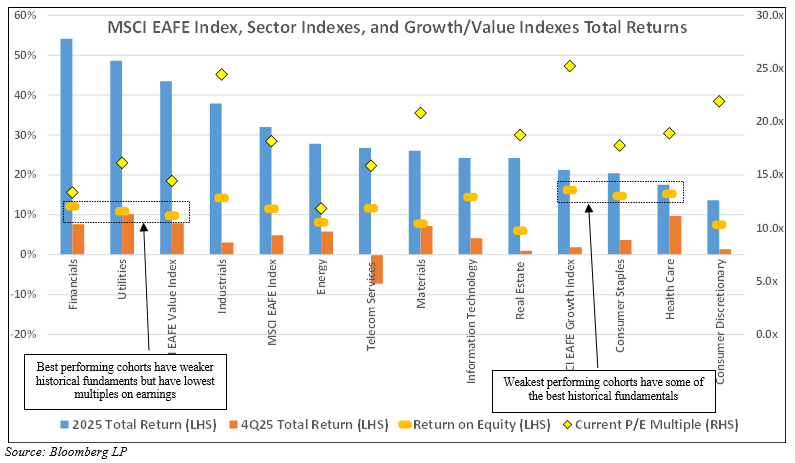

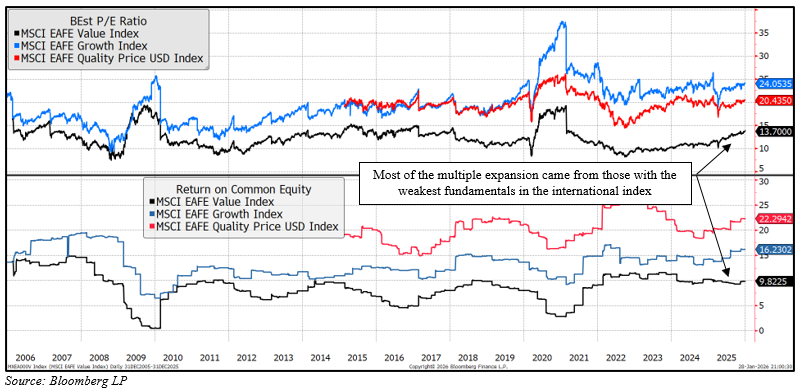

Within the EAFE family of indexes, value stocks were the clear winners. MSCI EAFE Value significantly outperformed with a total return of 42.5%, greatly exceeding the broad MSCI EAFE Index’s 31.0% return. MSCI EAFE Quality Price and MSCI EAFE Growth Indexes lagged with total returns of 20.5% and 20.2%, respectively, underperforming the parent MSCI EAFE Index by approximately 10 percentage points.

This price performance continues to reflect an acute rotation towards the international markets and a steeper yield curve, benefiting the Financials and more cyclically sensitive sectors. This market has been more challenging for quality-biased managers with longer horizons, as rising tides lift all boats, particularly those constituents with historically poorer fundamentals within these benchmarks. The strong performance across sectors and regions highlights the resilience of international markets amid global tariff concerns and shifting capital flows.

Sector dynamics were notable, with the MSCI EAFE Utilities sector surging for a 55.3% total return, which includes dividends, on the back of lower rates, rising power demand, and higher electricity prices, while financials and mining shares contributed heavily to the UK’s outperformance. In contrast, consumer discretionary stocks lagged, reflecting subdued spending across developed markets, as consumer sentiment continues to track well below pre-COVID levels, though improving marginally from the declines during the first four months of 2025 for the Eurozone.

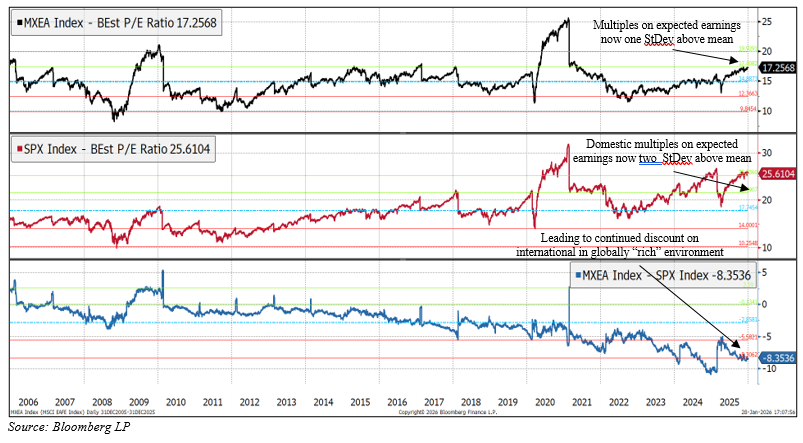

As noted, MSCI EAFE Index delivered a 31.9% total return in USD terms during 2025, driven primarily by valuation re-rating and currency movements rather than fundamental earnings growth. Multiple expansion contributed approximately 16.5% to the returns, as the P/E ratio expanded from 14.8x to 17.2x, while currency effects added 10.1% from the appreciation of EAFE constituent currencies against the USD. In contrast, trailing 12-month earnings per share grew by only 4.5%, contributing modestly to overall performance. As a result, approximately 83% of the total return came from the combination of multiple expansion and favorable currency movements, with a much smaller contribution from earnings growth. The MSIC EAFE Index’s strong performance was overwhelmingly valuation-driven rather than fundamentals-driven.

Over the past 15 years, the MSCI EAFE Index has consistently traded at a notable discount to the S&P 500 Index on a price-to-earnings basis, reflecting persistent valuation gaps between international developed markets and U.S. equities. While the EAFE’s P/E ratio has fluctuated with global cycles – rising during periods of optimism and compressing during downturns – it has rarely closed the gap with the S&P 500, which benefits from higher growth expectations, better shareholder returns fundamentals, and larger share of technology leadership. Even during years of strong EAFE performance, such as 2025 when the broad index delivered outsized returns, the valuation premium of the S&P 500 remained, though narrowing by two turns during 2025.

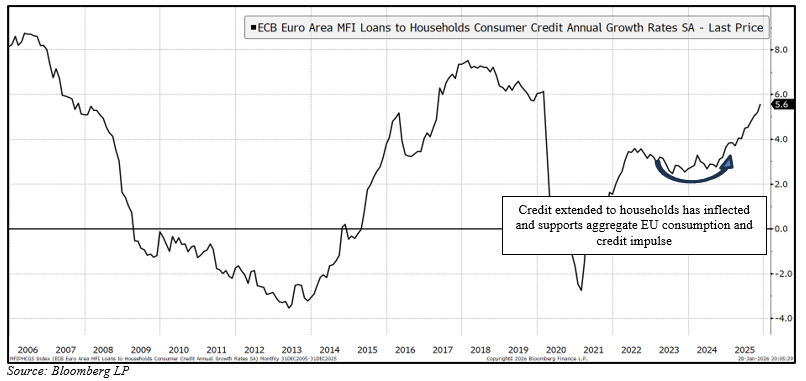

Euro‑area credit data show a modest but broadening in November: adjusted loan growth accelerated to +3.0% YoY (from 2.8%), with +0.4% MoM exhibiting momentum. Corporate credit edged up to +3.1% YoY. Among the “big four,” Germany remains soft, France steadies, Italy improves, and Spain cools slightly. Household lending rose to +2.9% YoY providing support for domestic consumption and residential construction with both mortgages up +2.7% YoY, while consumer credit surged to 5.6% YoY in the Euro-area, according to the most recent European Central Bank data. This mix suggests financing conditions are no longer tightening and beginning to pass through, selectively, to the real economy.

The Bank of England restarted its easing cycle, cutting the Bank Rate to 3.75% (from 4.00%) on a close vote and signaling a gradual path downward, although inflation risks remain. Headline inflation ticking up to 3.4% in December. Meanwhile, the ECB held its deposit rate at 2.0%, describing policy as in a “good place” with Euro-zone inflation sitting at 1.9%, though services inflation of 3.4% remained high. This elevated level continues to drive Core CPI at 2.3% – above ECB target of 2.0%. European Central Bank projections point to headline inflation remaining below target in 2026, while growth is lifted by investment (AI, pharma in Ireland) and targeted public outlays (Germany’s infrastructure/military). Expectations are for core inflation to glide toward the target as the year progresses. Market pricing implies most European central banks are winding down their cutting cycles, and the ECB is expected to hold ~2% through 2026. The Bank of England will likely deliver at least one more cut, as inflation risks are expected to recede.

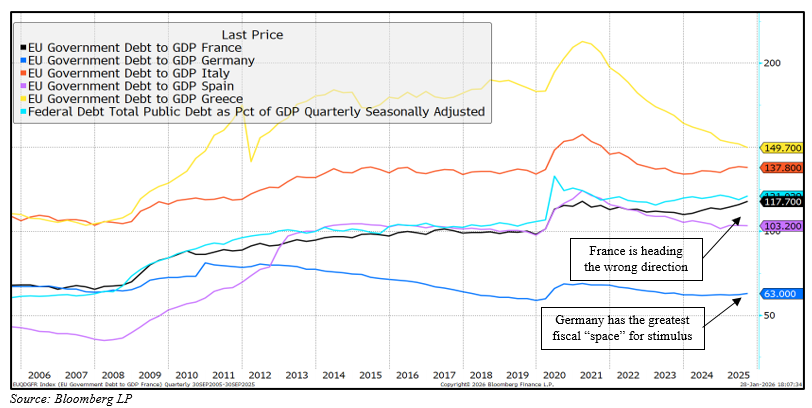

Consensus forecasts estimate Eurozone real GDP growth of around 1.4% in 2025, 1.0–1.2% in 2026, with a later‑cycle, investment‑led upswing beyond 2026. France sits near 0.8% for 2025, with an outlook for marginal improvement to 1.0% in 2026, aided by consumer resilience despite fiscal challenges and political unrest. Euro‑area unemployment should stabilize near 6.4% in 2026. Fiscal space is limited in many large economies, and aggregate euro‑area fiscal stance remains restrictive into 2026. Key downside risks remain with U.S. tariff shocks on EU goods, China‑EU trade frictions, and domestic policy slippage.

Germany’s long symbiosis with China is fraying. As Chinese producers gain share in capital‑goods, chemicals, and EVs – helped by a weak CNY and massive subsidies – German policymakers are pivoting toward protection and “Europe‑first” procurement in strategic sectors. This shift includes tightening rules on Chinese tech in networks and launching critical‑minerals diversification. German imports from China have surged while exports fell, deepening a record trade deficit and contributing to a 14% slide in manufacturing output since 2017 and job losses. Industry groups now press for anti‑dumping tools and advocating probes into Chinese trade practices. The policy implications for markets are likely more trade remedies, localization incentives, and a structurally tougher backdrop for EU‑China trade. This shift could be supportive for selective European industrials with competitive moats, yet margin‑negative for energy‑intensive chemicals absent cost relief and more balanced regulatory and power framework.

The outlook for French real economic growth is very modest during the fourth quarter of 2025, with 2026 real GDP growth rising to 1.0%. Fiscal strain, as debt exceeds 110% of GDP with large fiscal deficit, has limited any scope for a fiscal impulse to help contribute to growth. Fiscal deficits exceeding 6% in 2024 have prompted attempts towards austerity in order to normalize towards a 2% deficit by 2029. The pollical backlash has led to a challenging situation in securing a budget. This prompted the leadership to use Article 49.3, which allows passage without a parliamentary vote after months of failed negotiations. Despite these budgetary challenges, the credit impulse and resilient consumer should support a positive growth outlook. France’s medium‑term path leans on gradual disinflation, wage normalization, and broader European capital investments. The chief near‑term risk remains external demand shocks due to tariffs and further internal political unrest, as The Socialists push for a budget that avoids pension reform and raises taxes on both individuals and businesses.

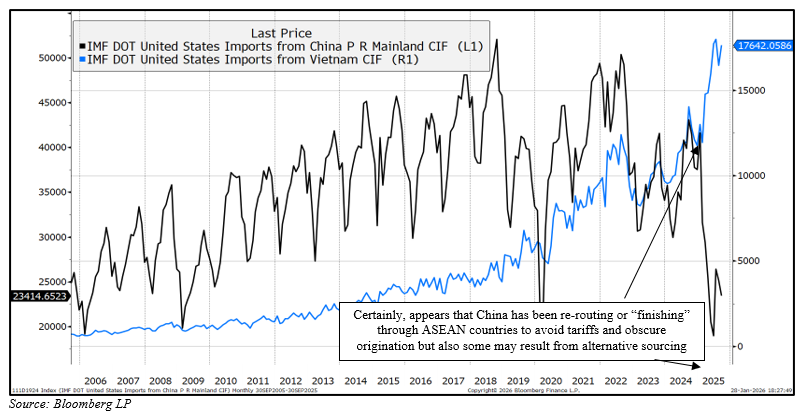

China posted exactly 5% real GDP during 2025, matching the official target, but the composition is increasingly lopsided and credibility is questionable – at best. A spike in exports accounted for ~33% of GDP growth during the year, the highest share since the late 1990s. Fixed‑asset investment (FAI) fell 3.8% for 2025 – the first annual decline in the history of the series – amid property retrenchment (property investment −15.9% January–November), cautious manufacturing capex (“anti‑involution” campaign), and local‑government deleveraging. Retail sales decelerated to +0.9% YoY in December, capping six consecutive months of deceleration, and the GDP deflator has been negative for ten straight quarters, underscoring continued deflationary pressure resulting from excess supply and weak domestic consumption.

Despite steep declines to the U.S., China re‑routed exports to Africa, ASEAN, India, and the European Union, delivering a record $1.19T trade surplus in 2025. Products include EVs, industrial, hi‑tech goods, and “supply‑chain finishing,” particularly, in ASEAN in order to circumvent tariffs. This success, however, raises the risk of retaliation as partners cite dumping production into other markets after subsidizing overcapacity. China’s manufacturing sector faces severe challenges due to overcapacity, which have led to falling prices, shrinking margins, and a steep decline in industrial profits. Profits at large industrial companies fell 13.1% in November 2025, nearly wiping out annual growth. This anemic profit growth contrasts with previous decades when manufacturing profits consistently contributed to China’s rapid economic growth and grew in-line with nominal GDP.

The slump in fixed asset investment reflects property adjustments, tighter local finances, and state pressure to curb wasteful spending (the “anti-involution” effort), even as Beijing prioritizes “new quality productive forces” (advanced manufacturing, tech). Policymakers pledge more proactive fiscal programs in 2026 but have not launched a broad “bazooka.” Additionally, modest attempts in the prior years have not resulted in material responses for domestic consumption or residential markets. Monetary settings continue to be restrained to avoid stress on their currency. The result has been a slow‑pivot toward targeted support rather than wholesale stimulus, keeping deflation risk alive and profitability under pressure.

Demographics continue to deteriorate, as population fell a fourth straight year. Working‑age cohort remains under pressure, where, despite decrease in numbers, youth unemployment remains elevated. Youth unemployment hovered ~17% late in 2025. Despite the adjustments for students in 2023, this series has continued to rise in the adjusted, new data series over the last few years, but the numbers have stabilized somewhat in recent months. Interestingly, the hukou system under the communist regime sustains a two‑tier social model that constrains mobility and access to social services. This undermines stability for much of the population and may have contributed to a partial retreat from urbanization, as the “Cunpiao” (Village Drifter) movement now shows some unemployed workers returning to the countryside. The urbanization phenomenon of increased output resulting to solely to urbanizing latent manhours no longer provides an easy formula for the CCP, manifest in their current emphasis on productivity, automation, and unemployment.

The outlook remains more challenging for China than during the first decade of the millennium. Many expect persistent disinflation, and growth remains dependent upon high external trade surplus. Continued push on exports to drive growth could lead to additional, periodic trade skirmishes. For example, Europe increasingly frames China as a “systemic competitor,” and Germany’s policy shift is emblematic. Risk assets geared to China’s domestic demand face a slow grind. It will be important to monitor the breadth of fiscal support to households, enforcement of anti‑overcapacity rules, and partners’ trade remedies to guide the outlook for China over the next year and beyond.

In Japan, growth remains sluggish in real terms, decreasing at a 1.8% annualized rate in the third quarter of 2025. Current real GDP is barely above 2018–19 peak, but nominal activity remains strong, as GDP deflator and CPI have inflected from deflationary pressures emerging in 1995, remaining above 2% since 2022. A large fiscal package, estimated at 2.5% of GDP, risks sticky inflation. The consumers remain strained and low confidence remains from households, although have risen some over the last few months.

Real Gross Fixed Capital Formation sits 7% below the long-term trend, hampering potential growth amid population decline. The yen is near multi‑decade lows, but JGB yields are now rising toward nominal growth. Historically (1985–2010), these yields remained above nominal GDP growth, making a 4% yield conceivable if they have bucked the deflationary curse. We see the Bank of Japan remaining steady over the near term to keep real policy rates low – currently at 0.75% – and stimulative despite elevated inflation. Over the medium‑term gradual hikes could be expected if inflation remains elevated – current GDP deflator was 3.4% for the third quarter. We expect the 10‑yr JGB to drift toward ~2.75% by end‑2026, steepening the yield curve for government issues. We would be cautious on rate‑sensitive defensives and foreign currency exposed importers, particularly if yen strengthens with long higher rates.

Canadian growth likely stagnated during the fourth quarter, leaving a real estimate for real GDP of ~1.6% for 2025 on mixed drivers. Estimates rose a few tens of basis points, as tariff threats with the United States eased during the summer months. The third quarter was flattered by falling imports, propping up real GDP to a 2.6% annualized growth, further supporting higher – albeit anemic – estimates. Pundits cluster 2026 at real GDP growth estimates around 1.1–1.2%, reflecting weak productivity and soft consumption. The Bank of Canada has paused at 2.25%, indicating the rate‑cutting cycle has effectively ended. There could be some hope for monetary policy transmission to prompt further expansion, but this monetary cycle commenced in 2024 with most of the policy rate dropping during 2024. With a prolonged hold through 2026, as inflation trends near 2%, there remains limited scope for further cuts, and we expect policy to remain largely on hold during 2026. Labor markets deteriorated during 2025 with recent job gains skewing toward part‑time, suggesting persistent underemployment. Policy mix implies a low‑beta path of gradual disinflation, modest capex, and export‑demand sensitivity.

As we enter 2026, the global economic outlook is increasingly shaped by a convergence of geopolitical pressures, including ongoing armed conflicts in regions such as Ukraine and the Middle East, which continue to elevate global instability. Intensifying geoeconomic tensions – particularly between the U.S. and China through sanctions, tariffs, and competition over critical resources – are fragmenting trade systems and raising risks of supply chain disruption, while scrutiny of Chinese industrial policy is expanding in Europe, adding further strain. At the same time, cybersecurity threats, digital sovereignty disputes, and increasing government regulation of AI are escalating, potentially splintering technology markets. Rising populism, fiscal stress, and policy uncertainty in major economies such as the UK and France amplify volatility, while broader risks such as potential military escalations compound an already fragile global backdrop. Collectively, these factors create a complex, uncertain environment that threatens growth, investment confidence, and market stability as 2026 unfolds.

Mason D. King, CFA

January 30, 2026